Avoiding Audit Traps

By Toni Buffa ![]() | Published February 14, 2023

| Published February 14, 2023

Depending on your industry (especially healthcare, finance, government contracting, insurance, etc.), you may be subject to a regulatory audit. By definition, an Audit is the examination or inspection of various books of accounts by an auditor, followed by physical checking of inventory to ensure that all departments follow a documented system of recording transactions. Government agencies use audits you provide to review and confirm that proper standards were followed and ensure that you can identify sources. The result is a bigger tax bill for organizations that fail an audit, and you'll also owe interest on those taxes. Your organization needs a consistent system to keep books, inventory, and record transactions. Without it, you can imagine the audit process will be very stressful.

TL;DR

too long; didn't read

Depending on your industry, your organization may be subject to audits. Without a proper system to keep audit trails organized, you can imagine the auditing process will be stressful. Automation will remove the stress of worrying about audit traps.

To avoid audit traps, process owners should always know the documentation pertaining to their responsibility areas. In companies still manually preparing for audits, manila folders, envelopes, hanging folders, and filing cabinets are filled with various documents. All these would have to be filed through when the time comes, and hopefully, these will have all the proper documentation needed.

Audit Trails

Audit trail tracking is a must-have for any critical business process. An audit trail, sometimes called audit tracking, provides the following:

- Verifiable evidence that can be presented internally or externally.

- A sequence of tasks or activities that have been performed.

- What actions were taken.

- Information about who performed the task(s).

- Time and date stamps.

The Automated Audit Trail

As discussed above, the outdated way of managing these requirements would be with paper documents. With automation, the audit process does not need to be a stressful event. An automated system can quickly generate audit trails with all necessary critical information. Automated audit trails can take a considerable burden off organizations by providing detailed information in quickly-generated reports. Not only do they provide a defense for compliance purposes, but they also ensure user accountability. This accountability will ensure that future compliance efforts will be more effective.

Automated platforms also help by quickly generating audit trails. Audit trails are a backbone of compliance by providing a chronological history of all the events in any workflow. The audit trails will serve as the roadmap if a company needs to generate compliance reporting or pass an internal or external audit.

Audit Tracking Example

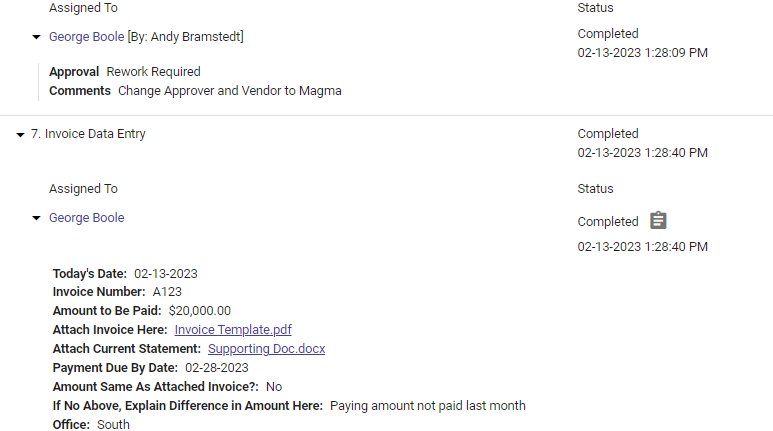

The screenshot example below shows a sample audit trail derived from Integrify. Integrify's "Request Detail" is entirely configurable by administrators, allowing for the removal or inclusion of summaries, KPIs, Open Tasks, Completed Forms, Related Requests, Request Records, Task History, and Reports.

As you can see, all necessary information is clearly shown here, including names, documents, amounts, and dates. Details on all processes will be found under the Request Detail section and can be easily located for auditing purposes. No expiration, no hassle, and no manual work. Your process is completely automated, from start to finish, giving you your data for your use any time you may need it.

Automation and Compliance

Another critical action that auditing looks for is ensuring your organization complies with regulations. Regardless of industry, the compliance function is responsible for ensuring that the company's policies and procedures are designed to comply with applicable laws and regulations. Then, ensuring that those policies and procedures are followed. Luckily, automation provides a consistent, secure, auditable workflow for any compliance system. Complete visibility is almost impossible when workflows are based on spreadsheets, emails, and paper documents. Automated processes offer greater transparency than manual ones. An automated platform allows continuous monitoring of operations and the ability to quickly identify and address compliance issues. Plus, it allows departments to monitor the changing regulatory landscape better.

“Before Integrify, we used paper ‘finance memos’ that weren’t all standard, that resulted in storage issues, that were often lacking the appropriate approvals and then later were difficult to look up and locate. Our users always had trouble finding the information before, but now employees know where to find it, it’s all in one place.”

– Elizabeth Petrie, Capital Planning Controller, BP

If you are tired of maintaining and tracking down paper documents for prepping for potential audits, it’s time to consider automation for your organization. To summarize, automation will remove the stress of worrying about audit traps. Automation results in fewer mistakes and faster processes, leading to better compliance with internal controls and regulatory requirements.

Get an In-Depth Look at Some of Our Compliance Solutions:

- Regulatory Disclosure Processes

- Security Incident Reporting

- Legal Hold Processes

- Litigation Services

Tags

audit trails

Categories

Project Management

Toni Buffa

Toni is a member of the Integrify marketing team and writes for the Integrify blog. Toni lives in Colorado and loves animals of all stripes.