Internal Controls for Better Compliance

Internal Controls are Critical to Maintaining Financial Compliance Programs

How Strong Are Your Internal Controls?

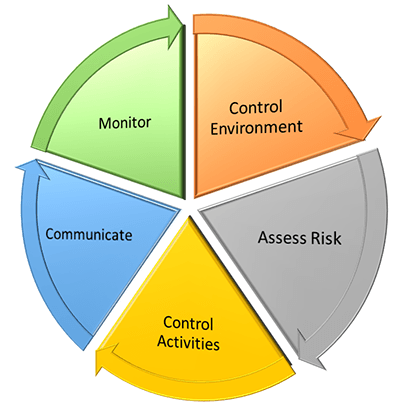

Organizations are tasked with providing proper risk prevention, risk assessment, and effective internal controls for operations, finance, HR, strategy, board of directors, and legal to ensure all corporate compliance obligations are met. To greatly improve organizational control and compliance from the front line to the executive ranks, controls should be standardized and automated with workflow management systems.

Related

What is an Internal Control?

Internal control is a process for consistently meeting organizational goals for operational effectiveness and efficiency, accurate reporting, and compliance with laws, regulations, and policies. While often referred to in a financial setting, controls are used across all areas within an organization from finance to IT to marketing.

Controls can be built around any procedures that present potential financial risk like capital expenditure approvals, hiring, customer data handling, quarterly financial report development, sales discount approvals, etc.

Ultimately, strong internal controls provide:

- Compliance with organizational policies

- Compliance with laws and regulations

- Protection against waste, fraud, and inefficiency

- Process compliance

- Reduced organizational risk

- Reporting accuracy and consistency across business units and departments

- Consistent information and communication

- Documented evidence of compliance or non-compliance for internal audit

- Management controls

- Separation of duties

- Preventive control

Any time there is an opportunity to make procedures more compliant using workflow automation systems, they should be considered. In many cases, simply applying a workflow system to an existing procedure drastically increases the likelihood of those procedures being compliant. We'll cover how this occurs in a later section. In addition, auditing capabilities ensure that all activities are documented and time-stamped with who, what, when, and why.

How Workflow Automation Enables Controls

Companies often employ workflow automation to provide a framework for processes in need of controls. Workflow automation provides consistent control procedures, segregation of duties, checkpoints, approvals, and structure that force process users to comply with established control activities. As a process user moves through a process, internal controls govern the information provided, when a process can proceed (if requirements are met), when a part of a process requires review, management response, etc. The process works the same for everyone, ensuring consistency.

Control Mechanisms

There are several internal control mechanisms that need to be in place to detect, prevent, and correct compliance issues:

- Published Standards and Policies

- Documented Procedures

- Training

- Monitoring

- Internal audit

Standard Operating Procedures (SOP)

Standard operating procedure design and automation seek to improve operational efficiency and ensure consistent processes are followed. This is done by documenting and communicating the organization's accepted practices, policies, and processes to get work done efficiently and consistently.

SOPs play an important role in maintaining organizational controls and ensuring the right people perform the right activities at the right time.

Looking for Ways to Improve Your Internal Controls?

We have a variety of resources to help you on your journey to an automated workflow.

Automate Your Internal Controls with Integrify

To see how quickly you can begin automating your internal control process, get a demonstration or trial of Integrify.